Crypto ETPs Face First Major Outflows of 2025 – What’s Going On?

The crypto market is always full of surprises, and last week was no exception. After nearly five months of steady gains, cryptocurrency exchange-traded products (ETPs) experienced a sharp reversal, marking their first major outflows of 2025. But what caused this sudden shift? Let’s dive in and break it all down.

Bitcoin Leads the Exodus, But Altcoins Shine

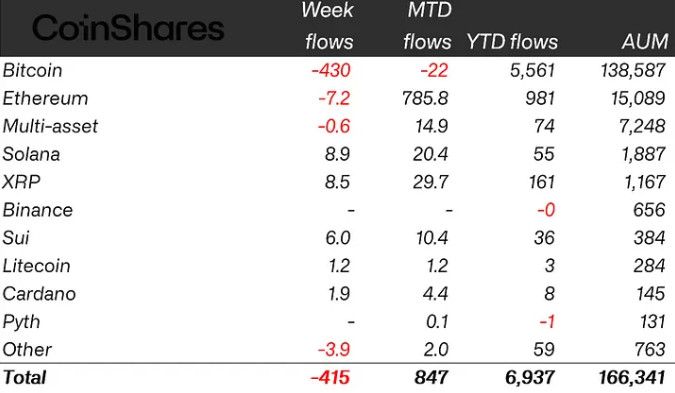

Over the past trading week, crypto ETPs saw a staggering $415 million in outflows, with Bitcoin (BTC) taking the biggest hit, losing $430 million in investments. However, this decline was somewhat offset by fresh capital flowing into altcoin-based ETPs, particularly those tracking Solana (SOL), XRP (XRP), and Sui (SUI).

According to a Jan. 17 report from CoinShares, the market turbulence might have stemmed from macroeconomic concerns, especially remarks from Federal Reserve Chair Jerome Powell, who urged patience regarding potential interest rate cuts. On top of that, recently released higher-than-expected U.S. inflation data added fuel to the fire, making investors wary of holding riskier assets like crypto.

A 19-Week Streak Comes to an End

Until last week, crypto ETPs had enjoyed an impressive 19-week inflow streak, a surge largely fueled by optimism surrounding the U.S. presidential election. During this period, crypto investment products accumulated a whopping $29.4 billion—significantly more than the $16 billion investors poured into U.S. spot ETFs during their first 19 weeks in early 2024.

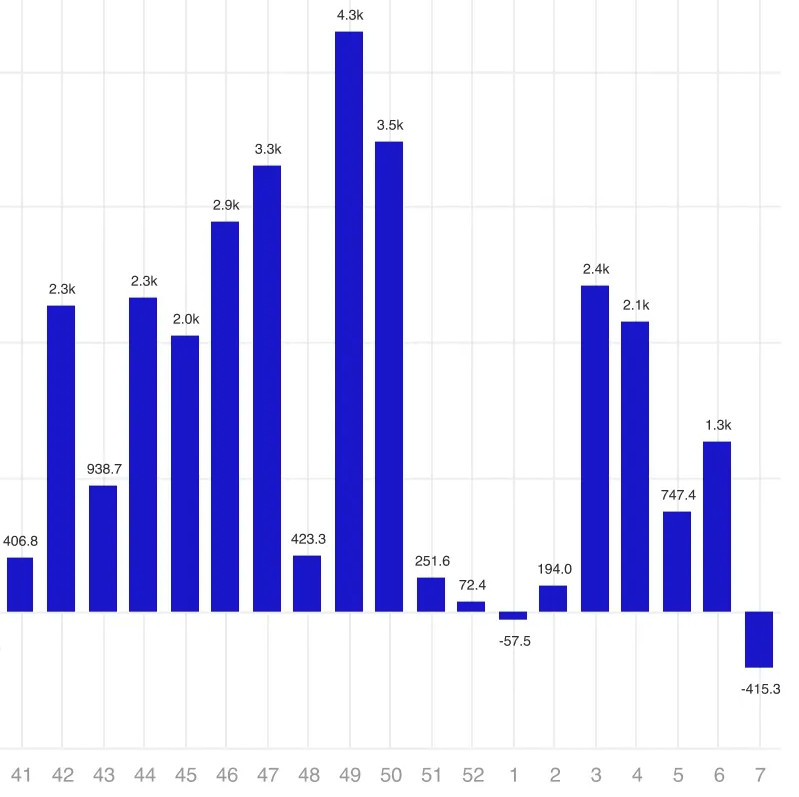

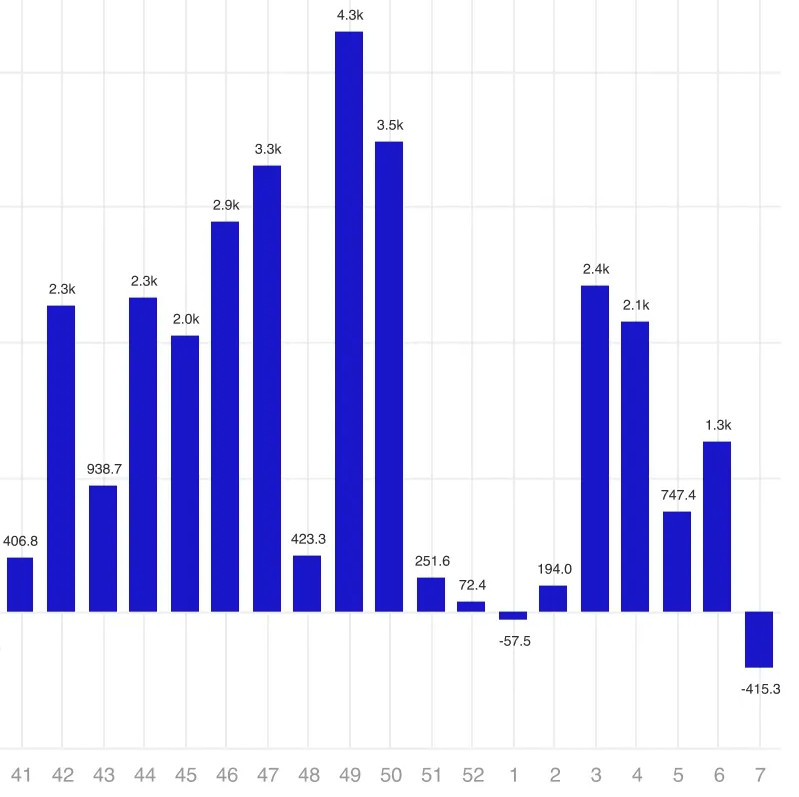

Crypto ETP Weekly Flows

Crypto ETP Weekly Flows

Weekly crypto asset inflows by the number of the week in late 2024 and early 2025 (in millions of US dollars). Source: CoinShares

Bitcoin’s outflows stand out because of its sensitivity to interest rate expectations. Investors tend to flock to BTC when they foresee loose monetary policy but pull out when economic uncertainty looms. Yet, interestingly, there was no corresponding rush into short-Bitcoin products, which instead registered $9.6 million in outflows.

👉 Related: Bitcoin analyst PlanB transfers Bitcoin to ETFs to avoid ‘hassle with keys’

Altcoins Stage a Quiet Comeback

While Ethereum (ETH) wasn’t entirely spared—losing $7.2 million in investment—some altcoins held their ground remarkably well. Leading the way was Solana, which saw $8.9 million in inflows, closely followed by XRP ($8.5 million) and Sui ($6 million).

Crypto ETP Asset Flows

Crypto ETP Asset Flows

Flows by asset (in millions of US dollars). Source: CoinShares

This growing interest in SOL and XRP-based investment products isn’t random. It comes amid mounting speculation that their own spot ETFs could soon receive a green light from U.S. regulators. According to leading Bloomberg ETF analysts Eric Balchunas and James Seyffart, a Solana ETF has an estimated 75% chance of getting SEC approval in 2025, while XRP’s odds stand at 65%.

👉 Magazine: Korea to lift corporate crypto ban, beware crypto mining HDs: Asia Express

What’s Next for Crypto ETPs?

So, is this outflow a temporary setback or the start of a broader trend? The answer likely depends on macro conditions and regulatory updates in the coming weeks. If inflation fears persist and interest rate expectations remain high, we may see further volatility in the market. However, with potential ETF approvals on the horizon, especially for Solana and XRP, altcoin interest might just be getting started.

For now, keep an eye on the Fed, the SEC, and, of course, the ever-unpredictable swings of the crypto market. Buckle up, because 2025 is already proving to be an eventful ride!