Bitcoin Surges in 2025: Why It’s Dominating the Crypto Market

The cryptocurrency landscape is constantly shifting, flooded with new tokens, trendy memecoins, and ever-evolving narratives. But despite the chaos, Bitcoin continues to reign supreme. As we step into 2025, Bitcoin’s market dominance has surged close to 59%, leaving altcoins in the dust. Let’s unpack what’s behind this massive shift and why investors are betting big on BTC.

Bitcoin’s Market Dominance: Standing Strong at 59%

The crypto market has seen an explosion of new tokens—nearly a million new tokens per week, according to Coinbase CEO Brian Armstrong. Yet, amidst the flood of memecoins and speculative altcoins, Bitcoin’s dominance index (BTC.D) continues to climb, defying bearish predictions from various analysts.

BTC.D has skyrocketed 15.50% in January alone and has surged by 55% over the past three years. Despite endless market hype around new projects, Bitcoin remains the anchor of the crypto industry—the digital gold that investors continue to trust.

Bitcoin Dominance Chart

Bitcoin Dominance Chart

Source: X

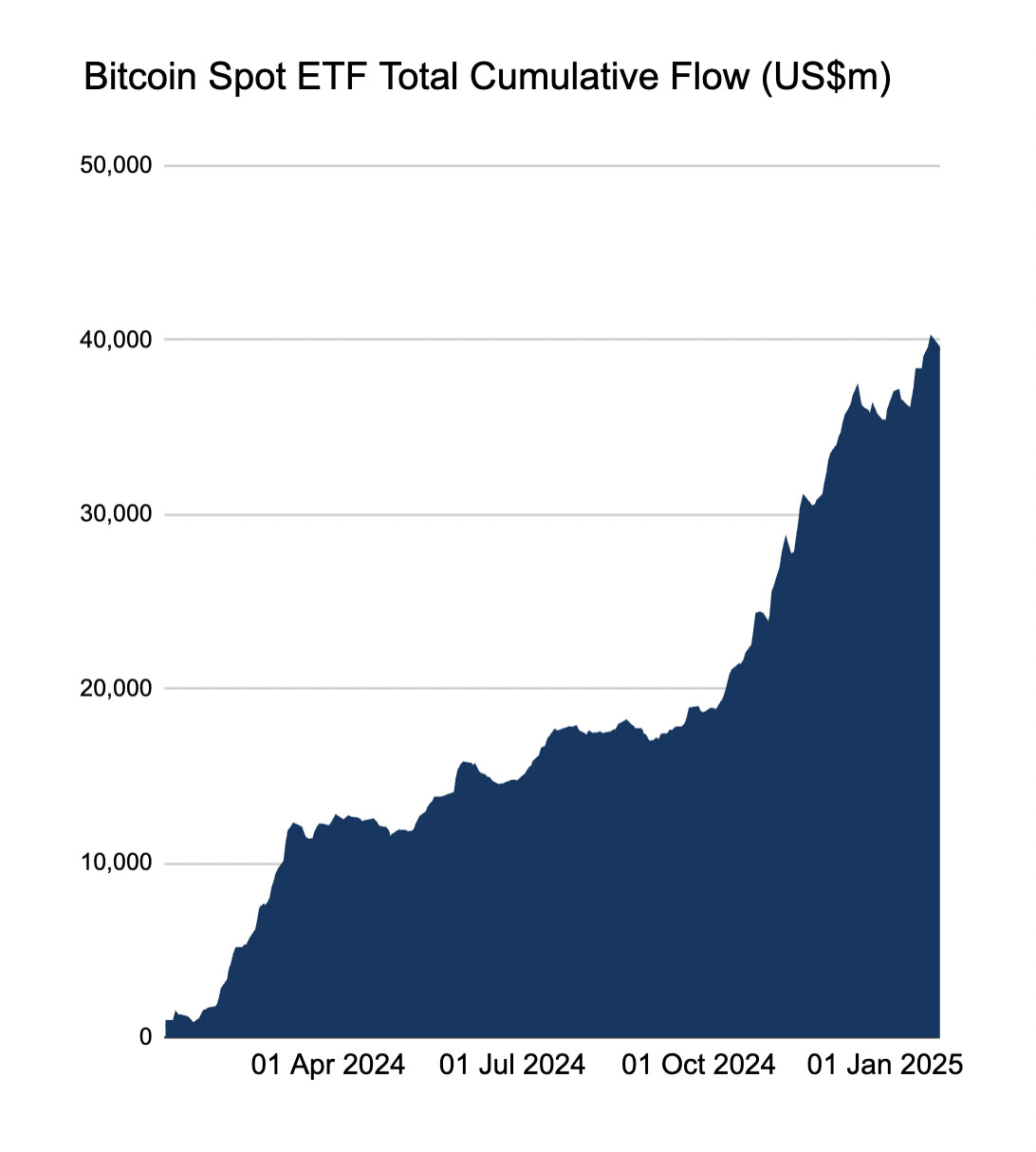

Institutional Money Floods In: Bitcoin ETF Boom

One of the biggest game-changers for Bitcoin’s growing dominance? The rise of spot Bitcoin ETFs (exchange-traded funds).

These investment vehicles have made BTC far more accessible to traditional investors, fueling demand like never before. As of late January, Bitcoin ETFs managed $39.57 billion in assets—a meteoric rise from just $1.17 billion a year ago.

Bitcoin ETF Inflows

Bitcoin ETF Inflows

Bitcoin ETF net cumulative flows. Source: Farside Investors

What’s even more telling? Bitcoin whales (large holders) have been aggressively accumulating BTC, especially via private transactions using CoinJoin, a privacy-enhancing feature.

Given these strong inflows, financial analysts—including those at Standard Chartered—are now predicting that Bitcoin could reach $200,000 by the end of 2025.

Politics and Bitcoin: Trump’s Pro-BTC Stance

The political landscape is playing a crucial role in bolstering Bitcoin’s position. President Donald Trump’s pro-crypto stance has emboldened Bitcoin advocates, with US policymakers increasingly warming up to BTC.

Several states, including Wyoming, Arizona, New Hampshire, and North Dakota, are even drafting legislation to allocate public funds for Bitcoin reserves.

On Jan. 23, Trump signed an executive order directing the Policy Working Group to explore creating a national Bitcoin stockpile. This marks a strategic shift in how the US views Bitcoin, reinforcing its reputation as a legitimate and valuable asset—something altcoins aren’t benefiting from at the same level.

While companies like Ripple push for altcoins to be included in this reserve, so far, Bitcoin remains the primary focus.

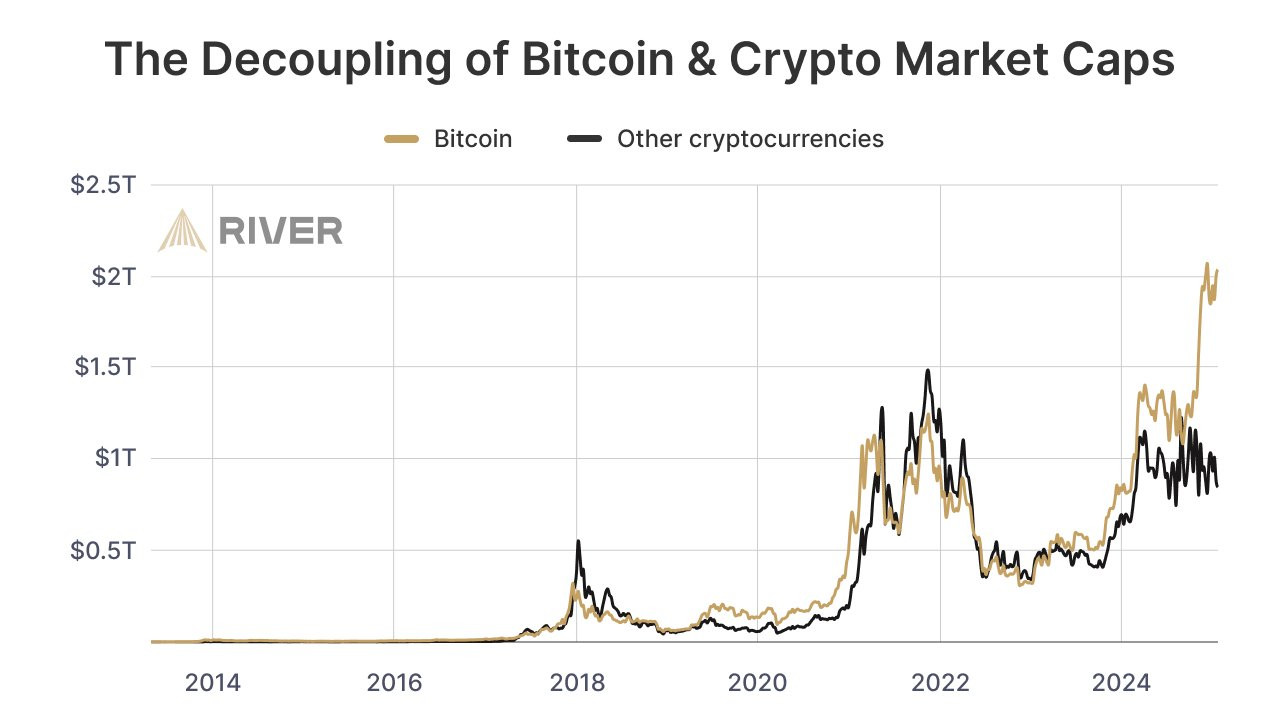

“No More Altseason” – Bitcoin Breaks Away From Crypto

For years, Bitcoin and altcoins moved in tandem—when Bitcoin surged, altcoins exploded even higher in speculative “alt seasons.” But the tide appears to be changing.

According to River Financial’s Sam Wouters, Bitcoin is decoupling from the broader crypto market like never before.

Bitcoin Market Cap vs Altcoins

Bitcoin Market Cap vs Altcoins

Bitcoin vs. other cryptocurrencies market cap. Source: River

“The truth is, there is no more altseason,” Wouters stated. Bitcoin is leaving the rest of “crypto” behind, proving its unique value as an asset.

Market analyst Tuur Demeester agrees, saying that “this cycle, Bitcoin is leaving crypto in the dust.”

Ethereum’s Struggles: The ETH/BTC Pair Hits New Lows

Not only is Bitcoin surging—it’s also leaving Ethereum in a prolonged downtrend.

ETH/BTC has plunged 65% since 2022, marking its longest losing streak against Bitcoin ever.

ETH/BTC Performance Chart

ETH/BTC Performance Chart

Source: X

While Ethereum ETFs have seen inflows, they pale in comparison to Bitcoin’s dominance. Analysts point to Ethereum’s high transaction fees and slower speeds as key reasons for investor hesitation—especially compared to fast-emerging rivals like Solana.

Moreover, leadership uncertainties within the Ethereum Foundation and disagreements over roadmap direction have shaken confidence in ETH’s long-term prospects.

Technically, if ETH/BTC breaks below 0.030 BTC, it could drop to 0.023 BTC, a level last seen in December 2017 and 2020. However, a bounce from 0.030 BTC could push ETH back toward 0.040 BTC in the coming months.

ETH/BTC Fibonacci Chart

ETH/BTC Fibonacci Chart

ETH/BTC three-week chart. Source: TradingView

In USD terms, Ethereum must reclaim $3,500 to regain bullish momentum—otherwise, it risks further downside.

Conclusion: Is Bitcoin the Only Crypto That Matters?

In 2025, Bitcoin is proving—once again—why it holds the crown. With institutional adoption soaring, political backing strengthening, and its dominance surging, Bitcoin appears to be in a league of its own.

On the other hand, Ethereum and other altcoins are struggling to keep up. If Bitcoin’s growing decoupling from the broader crypto market continues, we might truly be witnessing the end of the altseason era.

One thing’s certain: Bitcoin is cementing itself as the ultimate store of value in the digital age.

🔥 What’s your take? Do you think altcoins will make a comeback, or is Bitcoin the only real king? Share your thoughts below!

Disclaimer: This article does not contain investment advice. Please conduct your own research before making financial decisions. 🚀