Is SEC Chair Gary Gensler on His Way Out?

The Winds of Change at the SEC

Change is on the horizon for the U.S. Securities and Exchange Commission (SEC). According to Markus Thielen, founder of 10x Research, SEC Chair Gary Gensler is set to resign by early 2025—just months after the next U.S. presidential election.

The reason? A shift in political power. It’s a well-known tradition that a new administration usually brings a reshuffling of regulatory leadership. With President Joe Biden stepping away from his re-election bid and Donald Trump emerging as the likely winner, the writing may already be on the wall for Gensler.

A Trump Presidency: A Game-Changer for Crypto?

Thielen’s recent market report suggests that Biden’s sudden exit has all but handed the presidency to Trump. If that happens, a pro-crypto administration could take charge—a move that would be a stark contrast to Gensler’s regulatory stance.

“With Joe Biden dropping out of the US Presidential race, no credible candidate can seriously challenge Donald Trump. The November election appears to have been decided without a single vote. For Bitcoin, a pro-crypto administration will enter the White House.”

— Markus Thielen

If history is any guide, SEC chairs often step down when a new president takes office. While Gensler’s term officially runs until June 2026, Thielen expects him to resign by January or February 2025.

Gensler vs. Crypto: The Backlash Grows

Gensler has ruffled many feathers in the crypto industry, including with key political figures. Trump’s running mate, Senator J.D. Vance, has been outspoken about Gensler’s approach to crypto regulation—calling him the “worst person” for the job.

“He is way too political in his regulation of securities. He has it backwards when wanting to ban useful tokens and seemingly not caring about those without specific utility.”

— Sen. J.D. Vance

With a potential Trump administration likely to favor blockchain and crypto innovation, Gensler’s regulatory grip over the industry could soon loosen significantly.

The Bitcoin Boom: A Perfect Storm?

Aside from Gensler’s looming departure, Thielen points to a series of bullish indicators for Bitcoin. He hints that Trump may make a major announcement at the upcoming Bitcoin conference in Nashville, Tennessee, on July 25.

Speculation is high that he will announce Bitcoin as a strategic reserve asset, which could trigger a parabolic rise in Bitcoin’s price.

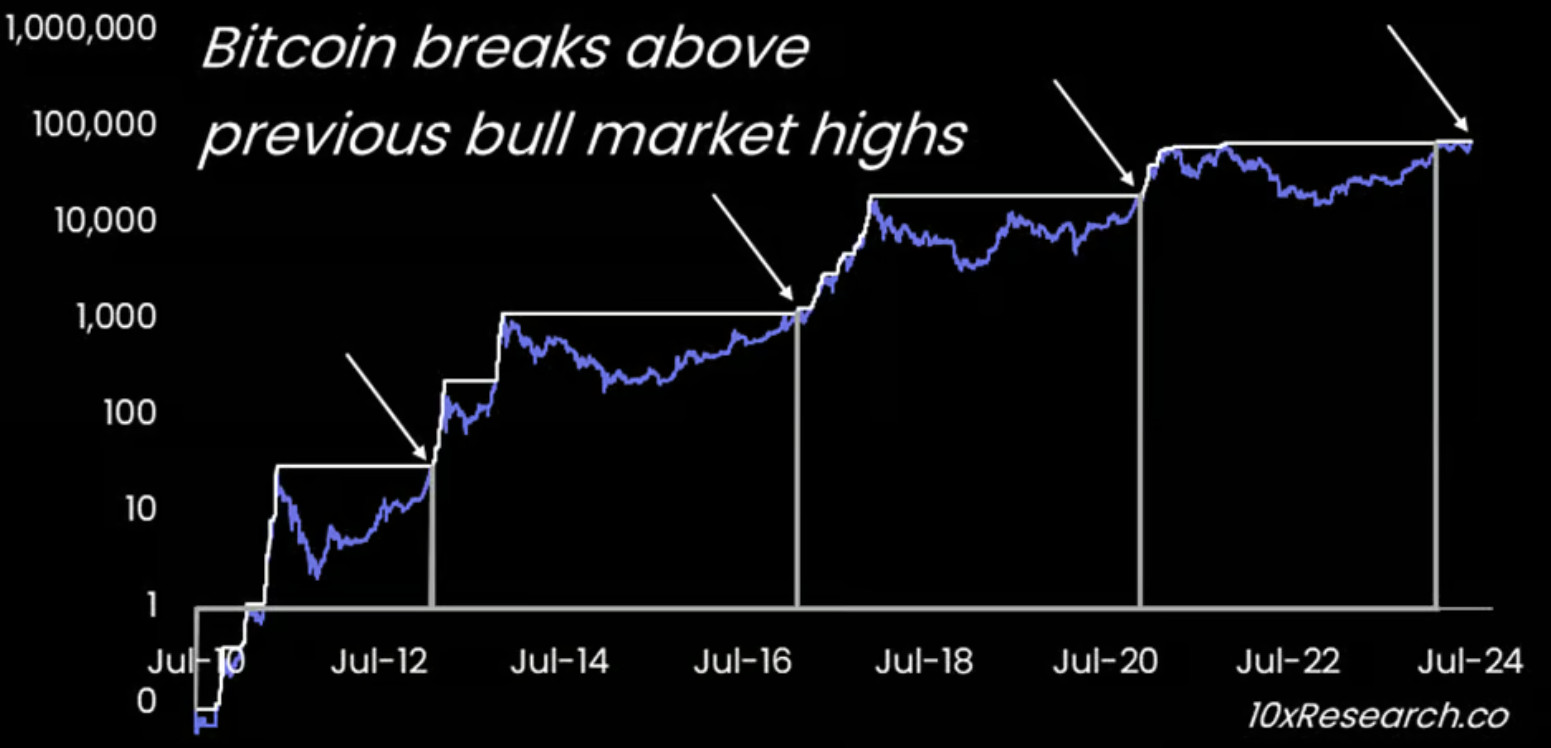

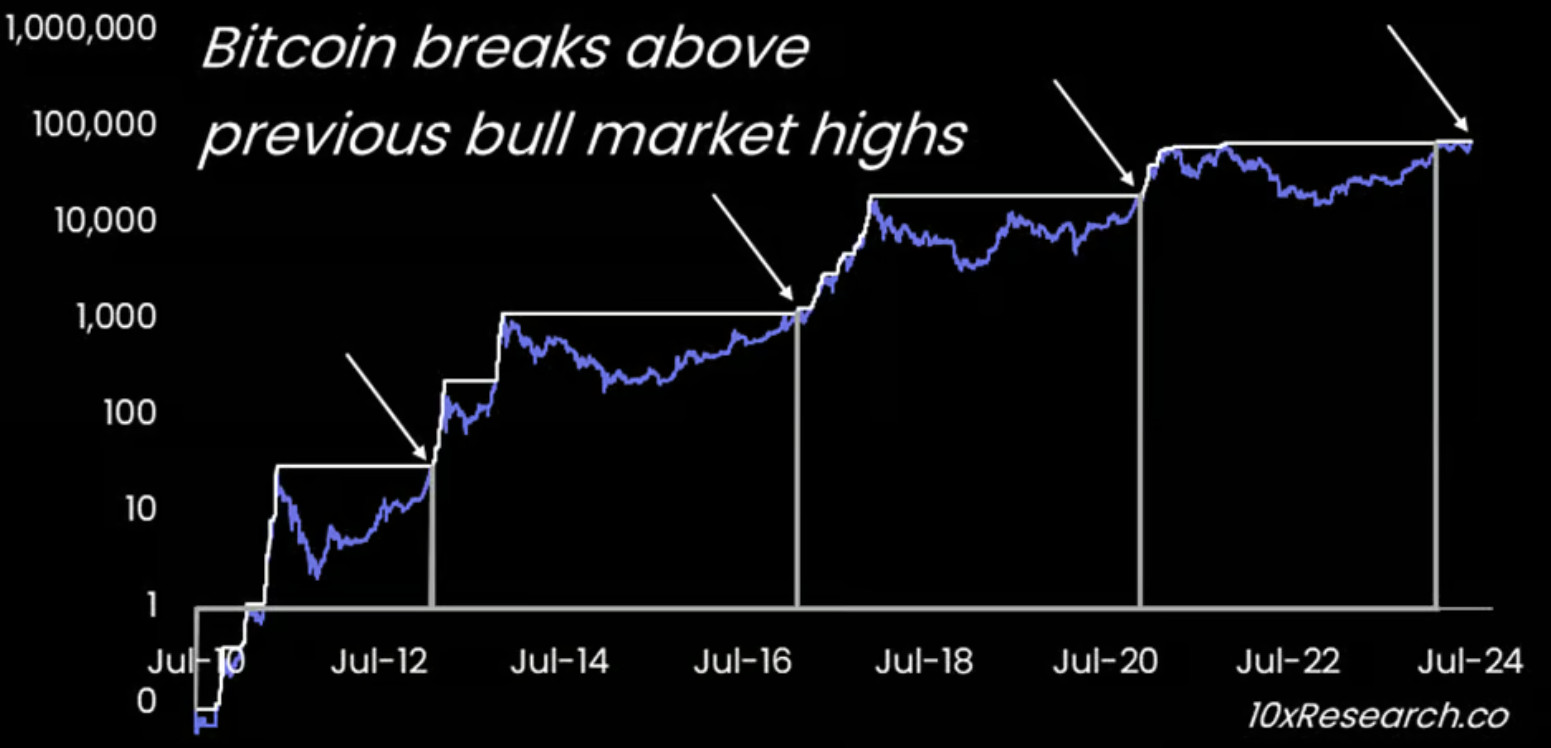

Historically, Bitcoin prices surge past previous all-time highs once a bull run begins—and if Trump signals strong support for crypto, we could see history repeat itself.

Bitcoin rally potential

Bitcoin rally potential

Historically, Bitcoin has traded higher after breaking previous bull market all-time highs. Source: 10x Research

Thielen warns against taking early profits or shorting BTC before Trump’s speech. With Bitcoin’s previous high of $68,300 potentially becoming the new launchpad, a parabolic move seems more likely than ever.

Crypto’s Future: Promising but Uncertain

Despite recent volatility in the crypto market—fueled by forced selling from the German government and repayments from Mt. Gox—analysts believe the worst may be behind us. Many experts argue that Bitcoin is on the verge of a significant rebound.

With political and financial forces aligning in crypto’s favor, 2025 could be a landmark year. Whether Gensler steps aside or not, the broader shift in U.S. policy could shape Bitcoin’s future for years to come.

Related Reads:

- Joe Biden’s withdrawal wiped $67M of crypto long positions in 30 minutes

- Crypto voters are already affecting the 2024 presidential election