The Future of Stablecoins: Trends and Predictions for 2025

Stablecoins have taken the crypto world by storm in 2024, shattering records with a circulating supply surpassing $200 billion by December. These digital assets—pegged to traditional currencies, primarily the US dollar—have become a core pillar of the crypto economy, commanding around 5% of the market.

As we look ahead to 2025, the momentum shows no signs of slowing. Industry experts are making bold predictions, from skyrocketing market caps to game-changing advancements in payments and interoperability. Let’s dive into what’s in store for stablecoins in the year ahead!

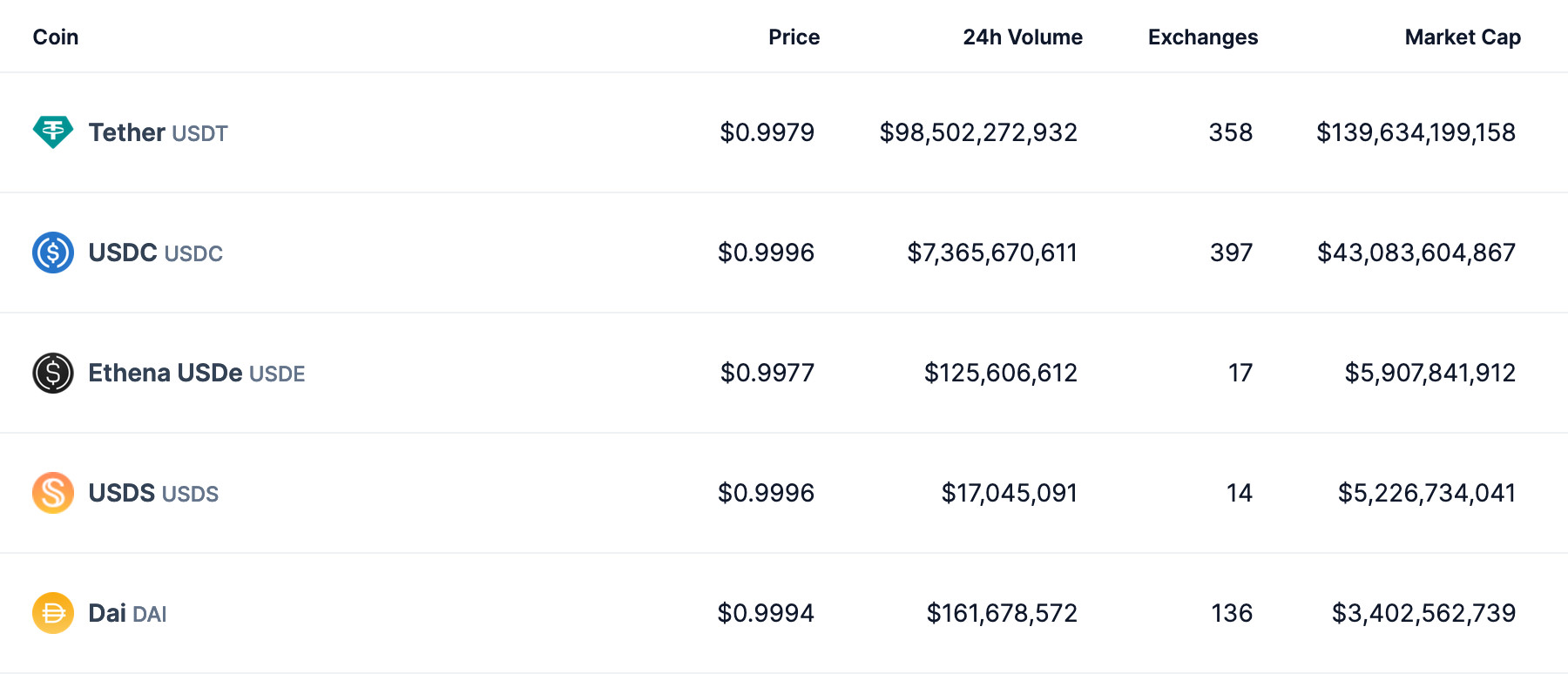

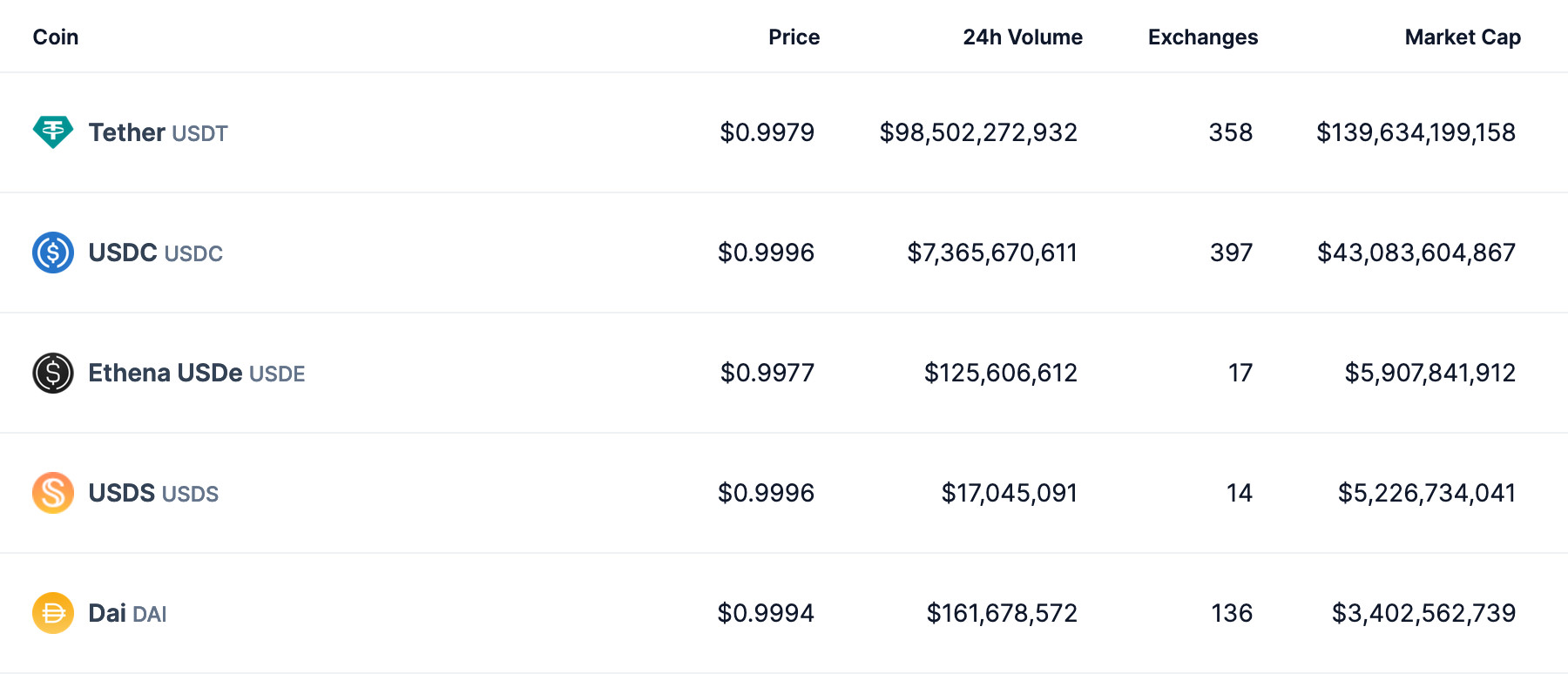

🚀 The Race to $300 Billion: USDT and USDC Stay on Top

If you thought 2024’s stablecoin boom was impressive, just wait for 2025. Experts predict the market will climb to a staggering $300 billion, with Tether (USDT) and USD Coin (USDC) maintaining their leading positions.

Guy Young, founder of decentralized stablecoin protocol Ethena, believes that Tether will continue to dominate:

“I expect we cross $300 billion in outstanding, Tether continues to dominate with their existing moat, and the rest of the market is challenged by new fintech and Web2 entrants with their own offerings.”

Meanwhile, Ailona Tsik, Chief Marketing Officer at Alchemy Pay, argues that established stablecoins like USDT and USDC will thrive due to their credibility and widespread adoption in global transactions.

📌 Fun fact: Some analysts project that over the next five years, stablecoins could grow into a $3 trillion market!

Top five stablecoins by market cap

Top five stablecoins by market cap

Source: CoinGecko

💳 Stablecoin Payments: Visa Anticipates a Boom

Stablecoins aren’t just tools for trading anymore—they’re on track to revolutionize payments. Visa’s head of crypto, Cuy Sheffield, predicts the rise of stablecoin-linked debit cards, allowing seamless spending of stablecoins just like traditional fiat:

“If 2024 was the year stablecoin demand picked back up, 2025 will introduce the next pivotal opportunity: the rise of stablecoin-linked cards.”

Visa isn’t alone in this optimism. Simon McLoughlin, CEO of Uphold, foresees a massive push toward cross-border payments, with stablecoins like Ripple USD (RLUSD) leading the charge.

💡 Stablecoin payments are already gaining traction. BitPay reports that although stablecoins make up just 5% of all transactions on their platform, they account for a quarter of the total transaction volume—meaning users are making larger purchases with stablecoins than with Bitcoin!

⚖️ Regulatory Rollercoaster: Stability or More Fragmentation?

While stablecoin adoption is booming, the regulatory landscape remains a patchwork of uncertainty. Industry leaders anticipate continued challenges in navigating inconsistent global regulations.

Ben Reynolds, Head of Stablecoins at BitGo, highlights the urgent need for clear guidelines to ensure stability and trust. Meanwhile, Vishal Gupta, founder of True Markets, warns of regulatory fragmentation, especially with Europe’s evolving crypto regulations under MiCA.

“Regulatory divergence could open opportunities in regions with clear, balanced rules but create challenges where frameworks are overly complex or restrictive.”

With Donald Trump set to take office in 2025, some expect greater clarity and consistency on stablecoin policies in the U.S. But will it be enough to provide the regulatory certainty the market needs?

🔗 What’s Next? L2 Expansion, Interoperability & Yield

Beyond payments, stablecoins are gearing up for major technological innovations in 2025:

🏗️ Layer 2 (L2) Adoption on the Rise

Stablecoins are expanding beyond Ethereum’s base layer to L2 networks like Arbitrum, Optimism, and Base. BitPay’s Bill Zielke sees this trend as “one of the biggest development areas” for the upcoming year.

🌉 Seamless Blockchain Interoperability

As crypto ecosystems grow, cross-chain functionality becomes crucial. Expect more efforts to make stablecoins move effortlessly across different blockchains, unlocking new use cases in retail and institutional markets.

💰 A Growing Market for Yield-Generating Stablecoins

Yield-bearing stablecoins are set to explode! Platforms like PayPal USD (PYUSD) already offer rewards for simply holding their stablecoin—and more projects are jumping in. Azeem Khan, COO at Morph, anticipates a rise in “yield-bearing stablecoins competing to attract users.”

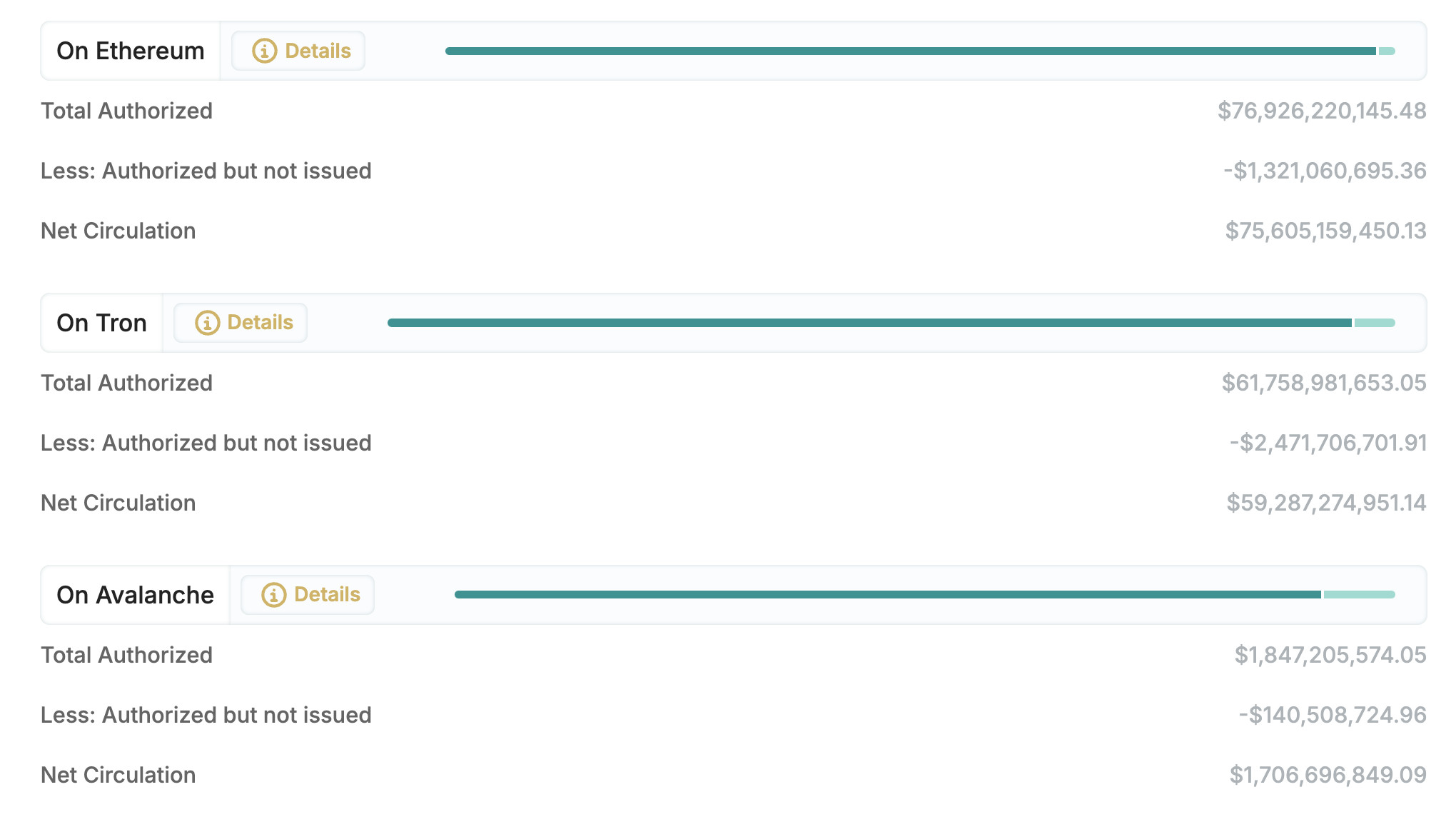

Ethereum, Tron, and Avalanche dominate USDT supply

Ethereum, Tron, and Avalanche dominate USDT supply

Source: Tether Transparency Report

⚠️ Beware of “Exotic” Stablecoins

With users chasing higher yields, risky stablecoin experiments are bound to pop up. Vishal Gupta warns that some of these “exotic” stablecoins might resemble complex financial products with hidden risks:

“The pursuit of higher yields will likely lead to the creation of ‘exotic’ stablecoins that act like structured financial products, embedding risks that retail users may not fully understand.”

📢 Key takeaway: Investors should stay informed and cautious, prioritizing transparency and understanding potential risks before diving into high-yield stablecoins.

🚀 The Bottom Line: Stablecoins Are Just Getting Started

2024 was a milestone year for stablecoins, but 2025 could be even bigger. With projections pushing $300 billion in market cap, the rise of stablecoin-linked debit cards, and innovations in yield generation and cross-chain interoperability, we’re entering a new era of digital payments and finance.

That said, regulatory hurdles and risks from “exotic” stablecoins remain. As with all things in crypto, staying informed and cautious is key!

🔎 What are YOUR thoughts on stablecoins in 2025? Will they become the go-to digital currency for everyday transactions? Let’s discuss in the comments! 🚀💬