Bitcoin Surges as Trump Vows to Make America a “Bitcoin Superpower”

Bitcoin is back in the spotlight after breaking past key resistance levels. With bullish momentum gathering steam, former U.S. President Donald Trump has thrown fuel on the fire, vowing to cement America’s dominance in the cryptocurrency space. Could this be the spark Bitcoin needs to soar even higher?

Trump Declares Ambition to Lead the Bitcoin Revolution

Bitcoin (BTC) clawed its way back above $86,000, reinforcing higher support as Wall Street trading kicked off on March 20. It marks another step in Bitcoin’s uptrend after promising macroeconomic signals from the U.S. Federal Reserve sent markets surging.

However, it wasn’t just the Fed’s stance that energized the crypto crowd. Donald Trump made waves at the Blockworks Digital Asset Summit 2025, vowing that the United States would become the global leader in Bitcoin and cryptocurrency.

In a virtual address, Trump made a bold declaration:

“Together we will make America the undisputed Bitcoin superpower and the crypto capital of the world.”

His promises didn’t stop there. He reaffirmed that his administration would not sell confiscated U.S. Bitcoin reserves and pledged to dismantle aggressive regulatory actions, such as the infamous Operation Chokepoint 2.0. However, there was little new information regarding potential Bitcoin purchases by the U.S. government.

Bitcoin Smashes Through Critical Technical Levels

Buoyed by Trump’s stance, Bitcoin bulls reclaimed crucial technical support levels. In particular, Bitcoin closed above its 200-day simple moving average (SMA) and 200-day exponential moving average (EMA)—historically strong indicators of a bullish trend.

Popular trader and analyst Rekt Capital was quick to highlight the significance of this move, calling the 200-day EMA a “long-term gauge of investor sentiment toward BTC.”

“Bitcoin has most recently closed above the 200 EMA and is now in the process of retesting it as support,” he wrote.

Beyond just moving averages, Bitcoin also broke out of a months-long downtrend in its Relative Strength Index (RSI)—a technical signal that suggests strong bullish momentum. According to Rekt Capital:

“Bitcoin has broken the Daily RSI Downtrend dating back to November 2024.”

Are Markets Underestimating the Fed’s Hawkish Tone?

While excitement is brewing in the Bitcoin space, some market analysts are urging caution. Crypto trading firm QCP Capital remains skeptical about the sustainability of the recent surge, warning that macroeconomic headwinds could still weigh on risk assets.

“Beyond the immediate excitement, the Fed’s tone was notably cautious. Policymakers downgraded economic growth projections to 1.7% (a 0.4% reduction), while raising their inflation forecast to 2.8%, signaling a growing risk of stagflation,” QCP noted in a message to its Telegram subscribers.

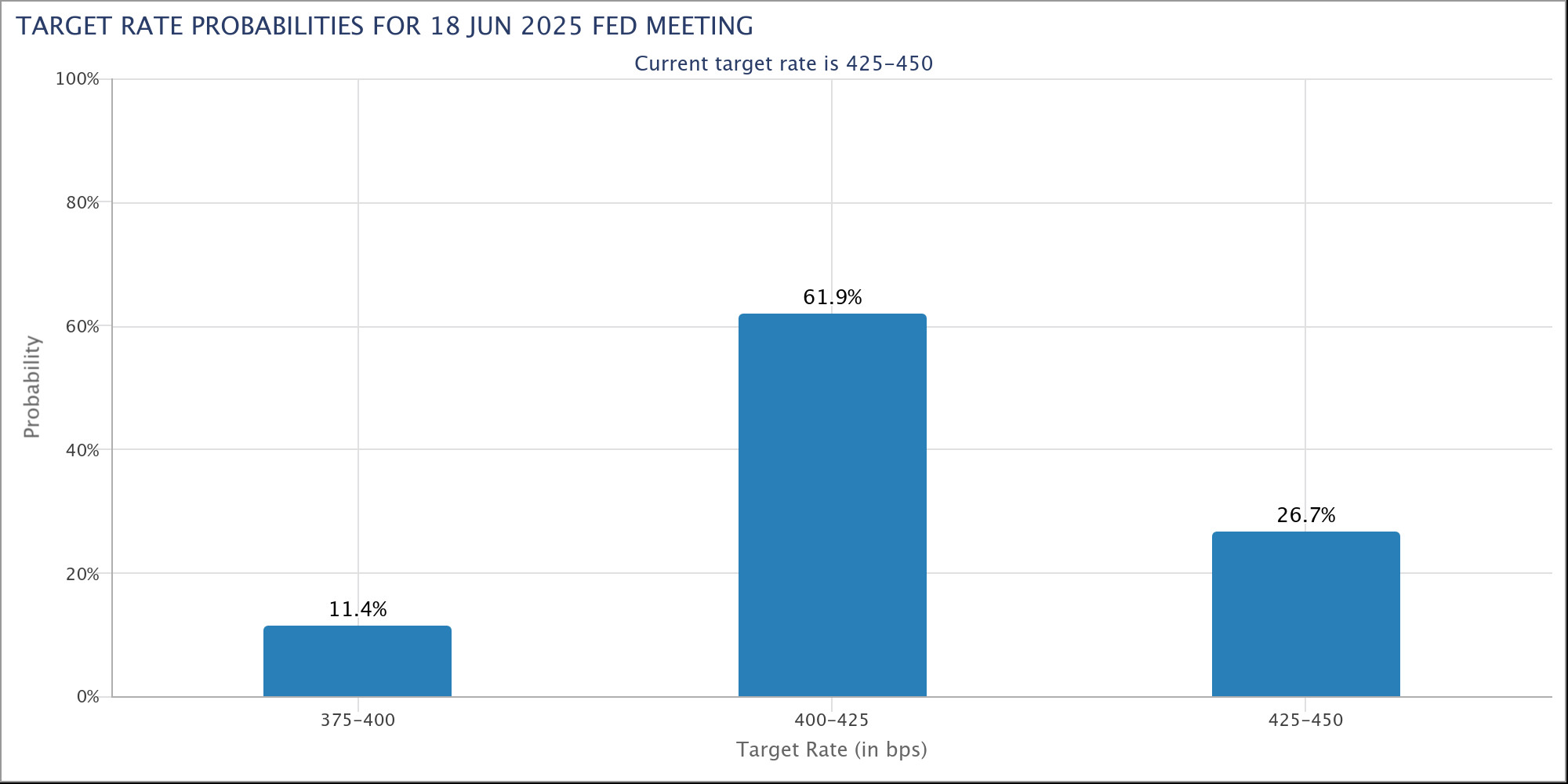

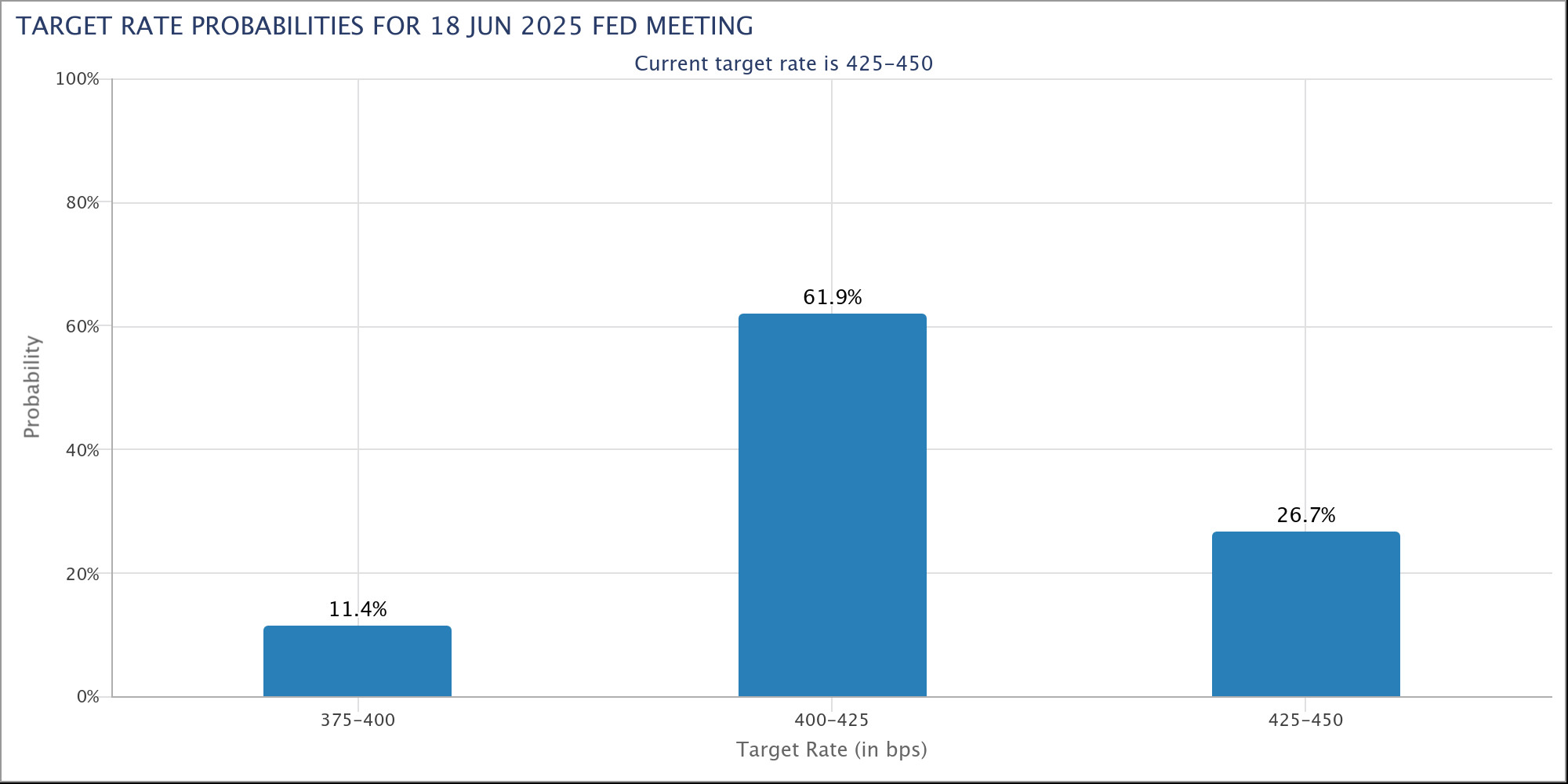

Even more concerning, the Federal Reserve’s dot plot suggests a more hawkish outlook, with an increasing number of officials now predicting no rate cuts in 2025.

According to data from CME Group’s FedWatch Tool, market expectations for interest rate cuts remain pinned to June at the earliest.

With uncertainty lingering, QCP Capital posed a critical question:

“Will the rally sustain, or will investors wake up to the reality that risks remain firmly in play?”

Final Thoughts: Can Bitcoin Capitalize on Political and Economic Shifts?

Bitcoin’s latest breakout, coupled with Trump’s pro-Bitcoin rhetoric, has injected fresh enthusiasm into the market. Yet, while the short-term technical indicators are flashing green, macroeconomic risks could still throw a wrench in the rally.

As always, when it comes to investing and trading, staying informed and considering all possible outcomes is key. Will Trump’s bullish stance on Bitcoin help push the cryptocurrency to new all-time highs, or will Federal Reserve hawkishness bring the rally to a screeching halt? The coming months will reveal which side wins out.

🚀 What do you think? Will Bitcoin remain on its bullish path, or are there more challenges ahead? Join the discussion in the comments! 🚀

This article does not contain investment advice or recommendations. All investments involve risks, and readers are encouraged to conduct their own research before making any financial decisions.